We use cookies to improve your experience on our website. By continuing you acknowledge cookies are being used. View the privacy policy.

What sort of investment options are there?

Getting on top of your super investments is a great way to help your balance grow faster. Find out more about the investment options you can choose from.

On this page

There’s a whole range of things you can invest in to get more money from your money. With all these options, there’s an important risk and return rule of thumb to keep in mind for making choices and getting the best outcome.

Some options are riskier than others – there is a higher chance you could lose money at some point during the time your money is invested. So why would you take more risk with your money? Because the money you’re investing is expected to grow faster and grow more in the long-term. Choosing investments with less risk means your money is safer from significant changes in value, but you can also expect less growth from your money

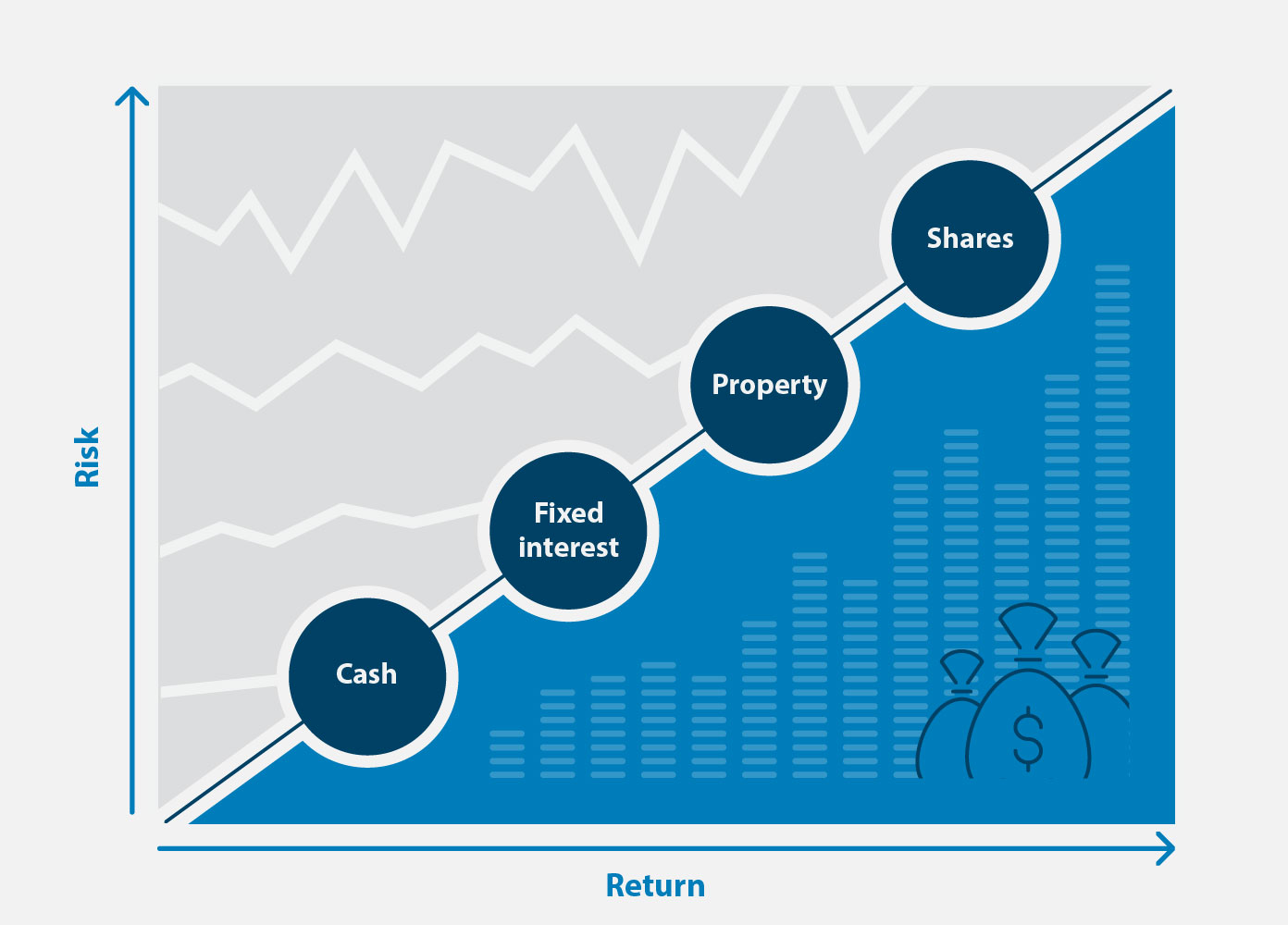

Here are some examples of how different sorts of investments measure up for risk and return. You’ll see that shares come with the highest risk and reward. Property and fixed interest come with a medium risk and reward. Keeping your money in cash, on the other hand, is very low risk but you can’t expect a lot of growth either.

Find out more about your risk profile and making good investment choices

Understanding the concepts and words you’ll come across when exploring investments in super can help you get to know which options could suit you best. Super funds will usually have a range of options which have different risk (and return) profiles by investing across a range of different types of assets. These options fall into three broad categories, based on how much risk you’re potentially taking and how much return you can expect to get.

Growth – as the name suggests, growth options are there to help you grow your balance faster. When you choose a growth investment option, your money will be invested in a mixture of different investment, with higher proportion of higher risk options – such as shares and property and a lower proportion of lower risk options – such as cash, term deposits and fixed interest. These options are expected to deliver a higher average return over the long-term but the value of your investments is likely to go down as well as up over time.

Defensive – sometimes called conservative, defensive investments put more of your money into lower risk investments. Your super balance is far less likely to go backwards but it’s average growth will probably be lower compared with a growth or balanced option.

Balanced – balanced options are designed to give your money the benefit of a blend of higher risk investments targeting higher growth, and lower risk investments with less growth. Because it’s designed to suit the ‘average’ super member, you’ll usually find that a balanced option is the default investment setting for a lot of super funds. However different funds will have different ideas as to what the ‘right’ blend is – despite being called ‘balanced’ most of these options have a slightly higher weighting to growth investments.

Here are a couple of other words you might see or hear as you explore investments on offer in your super fund. They can help you understand a little more about what you’re actually investing in and why.

Assets and asset classes – when we talk about growth, defensive and balanced options in super, these investments are made up of a whole mixture of assets. In investment-speak, when you buy or invest in something that has potential to grow in value, it’s called an asset. So bank accounts earning interest are assets and so are investment properties or shares in a company.

An asset class is the category that each of these assets belong to. So a bank account is in the cash asset class, an investment property is in the property asset class, any type of shares are in the equities asset class and so on. Each asset class – and the assets within it – comes with an expected level of risk and reward.

Diversification – when you invest in just one asset, like shares in a company, for example, all your money is in one place. That means you’re limited to earning a return – and taking a risk – on a single investment. This isn’t always a bad thing, and millions of Australians choose to invest their money in property because it’s something they understand. You might see this referred to as a single asset class option.

But what if the value of property were to go down, while the value of the shares goes up? Or if the opposite happened? If it’s invested across both asset classes, you’d be earning a better return from your money and taking less risk overall. This is called diversification and it basically means not putting all your eggs in one basket. This could be referred to as a multi asset class option.

When super funds are putting together their investment options, they’re choosing from all sorts of assets to help your money grow without too much risk that you’ll lose money too. So they use diversification to mix up assets and get the right balance of risk and return for their growth, defensive and balanced options.

Why not stick with the default option?

When you join a super fund, if you don’t choose how to invest your super, any savings you already have, and any new payments into your account, will be invested in a default investment option. This default option your super fund uses for investing your balance is called MySuper.

For some funds, MySuper is a balanced investment option. It’s the same for every fund member unless they choose something different. Other super funds take a lifecycle approach with their MySuper option for members. This means the investment option they choose for your super on your behalf is the one they think works best based on your age and how far away you are from retirement.

MySuper options are designed to be simple and low cost. This helps you to compare them easily and limits the fees you’ll pay for the super fund to invest your money. This might be the ideal choice for your life stage and the type of investments you feel comfortable with. But your super fund could have different options you can choose to help you get more from your balance.

Do all these investment options cost the same?

Changing investment options can mean paying more or less in fees to your super fund. There are a few reasons why fees can vary a lot across different options. Depending on how your money is invested, you may be paying more for the skill and experience of people the super fund has chosen to manage your money.

If you pay higher fees, you’re going to want a higher return so your balance grows more overall. This is one of the things you need to think about when looking at the different options for investing your super.

Get help with making investment choices

Even with a little – or a lot – of knowledge about the options, you may not feel confident choosing where your super should be invested. Should you choose one option for all your super savings or divide it up across different ones? Is your risk profile telling you to go with growth options only, defensive only or a combination?

If you’re keen to do more with your super savings, getting in touch with us can point you in the right direction. We can help you take steps to change your investments or point you in the right direction to get help from a financial advice professional who can talk through your goals and options for making the most of your super.